SIMALTO

was originally conceived for the purposes of product development and pricing -

its first applications were on trucks, copying machines and automobiles.

This SIMALTO invention was prompted by the artificiality of the then in vogue

(late 1970s) pair-wise conjoint methods involving many presentations of option

choices on the PC for the respondent to pick his preferred alternative.

The

utilities previously assigned to each of these options in the trade off were

changed a little, and then presented yet again in different combinations - and

so on until convergence of stability of all utility estimates, or boredom on the

part of the respondent (when he gave up).

Why

not simply ask what options people want, and which of these would they pay for,

and how much? Such a blindingly simple approach could not have waited

until 1979 to be invented! Indeed, and Ford showed the author a grid of

car attributes and options, with prices on them, circa 1947. (In those

days plastic seats cost more than the leather seats - new technology always had

inflated prices until the novelty wore off.)

Before

the organised and cost constrained option selection of the SIMALTO grid was

promoted, some methods simply presented each option and asked if it was wanted

and if so how much would they pay for it. This had the problems that each

option tended to be seen individually (not necessarily as part of a total

product with its other strengths/weaknesses) and respondents could spend the

same money "twice". A final totalling of the bill tended to

cause more respondent disappointment than a true revision of his priority

spends.

The

breakthrough in SIMALTO occurred in the mid-1980s when fast PCs enabled

rule-based expert systems to combine all the sensible standalone data from the

SIMALTO grid into reliable forecasts of which combinations of options, at what

price, would be preferred, by what number of customers, to a rival combination(s).

![]()

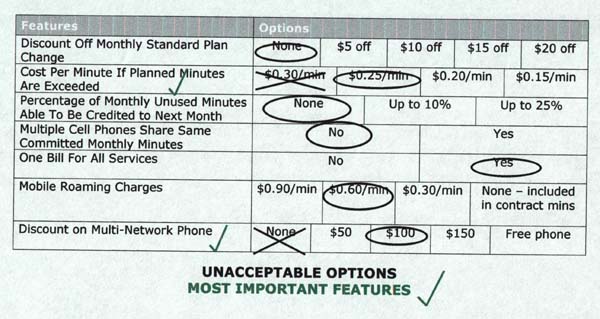

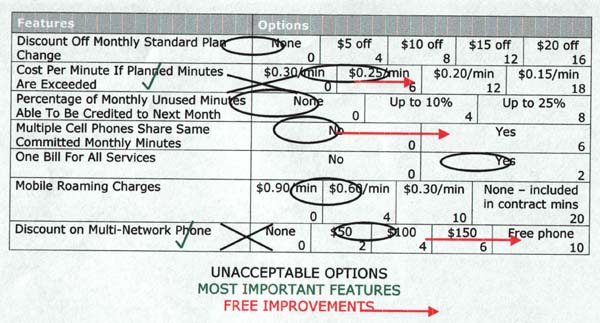

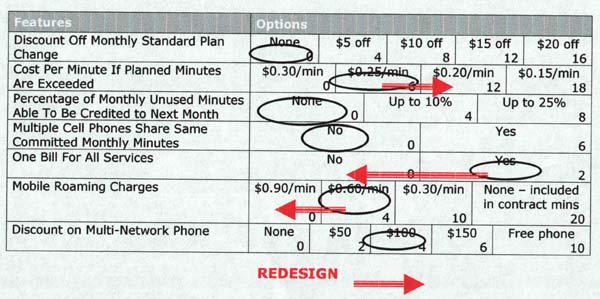

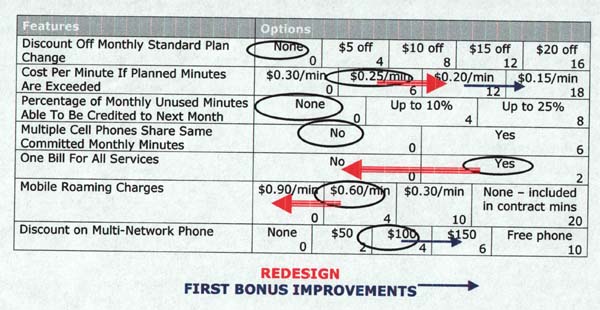

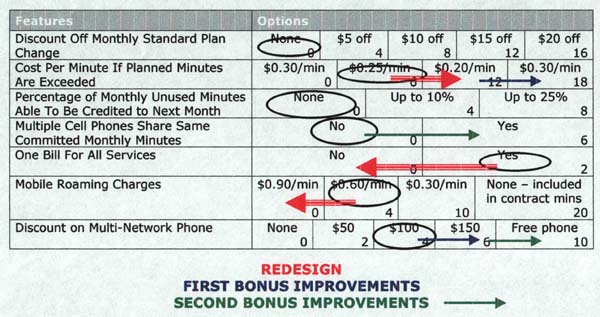

A grid is presented, as below, with all the attributes and different options in view, preferably simultaneously. One option in each attribute is marked (circled) as the starting point for the exercise. This circled position may be the respondent's perception of his current product or one supplied as a common start point for all respondents (particularly relevant for new products where previous use may not occur).

On this grid, optionally, several tasks are completed. The respondent:

1. Crosses out options that would be unacceptable to him, i.e. the product would not be able to perform the work expected of it if it had these optionse.g. on a telecom package for monthly commitment to both fixed and mobile phone calls

3. Indicates some preset number of 'free' improvements to the circled specification

The

respondent is now asked to focus on the numbers in each cell of the grid which

show the relative prices of the options. In the real world some

improvements cost more than others and real life customer choices reflect these

costs.

The respondent now completes two or more of the following tasks:

1. Re-designs

the first set of circles position so the sum of any improvements he desires

is matched by the series of savings he must make to ensure a net zero sum

cost change.

2. Allocates a pre-set budget to indicate his priority improvements to the previous specification

3. Repeats

Stage 2 with more pre-set budgets

4. Indicates how he would make a saving(s) of preset amounts to the original specification.

5. Finally, the respondent is usually asked how much he would really pay (need to save) for each of the above scenarios, and indeed which would be his preferred scenario at some sensible price.

The benefits of this

approach are discussed in the Methodological Advantages section. This

transparent and logical process allows customers to behave much as they do in

the real world when making decisions involving products and prices - i.e. making

significant purchases in a competitive product environment. All decision

factors are considered together in the total product context and in relative

proportion in a procedure which follows a logical, clear and incremental path,

taking respondents forward in steps that make sense.

Price is used as a

constraint on customer choices both at product option and total product levels,

thus allowing natural limitations of cost/ affordability to determine trade offs

which are made, and thereby generate models of requirements which reflect what

customers are willing and able to pay for, and not merely what they would like

to have in an ideal world.

Even the range of price each individual customer respondent is prepared to pay for an appropriate specification – his minimum and maximum price – can be integrated into product preference forecast simulations.